Yes, they can! Tax Rebates are there to fund your Learnerships. Capitalise on this investment – grow your business through learnerships – grow the economy through your success.

Learnerships are positive programmes that enhance the education and potential of your workforce.

In this article, we will give further details about tax rebates, specifically with regard to learnerships.

How do Learnership Rebates work?

Companies can earn maximum Skills Development points if they spend the required amount of their annual payroll on training initiatives.

The Rebate is made up of two parts:

An Annual Allowance

- This is available for each year of assessment in which the employee takes part in the learnership. (It is apportioned if the agreement was not in effect for the full year.)

- You may claim your Annual Tax Rebate when:

- The employee has completed an NQF level.

- During the year of assessment, an employee has registered a learnership agreement with you, the employer.

- The agreement was entered into, pursuant to a trade carried by the employer.

- The employer derived income from that trade.

- The Learnership Programme is registered with the relevant SETA.

A Completion Allowance

- A once-off allowance, available in the year of assessment in which the employee successfully completes the registered learnership agreement. It’s claimed in full regardless of which month the learnership was completed. It is claimed in addition to the annual allowance, meaning that in the year of completion, the employer can claim both the annual allowance and the completion allowance.

- You may claim your Completion Tax Rebate when:

- The employee has completed an NQF level.

- During the year of assessment, an employee has registered a learnership agreement with you, the employer.

- The agreement was entered into pursuant to a trade carried by the employer.

- The employer derived income from that trade.

- The employee successfully completed the learnership during the year of assessment.

- At the time of registration, the employer who registered for the agreement must be the same employer upon completion of the agreement.

- An agreement cannot be altered and must be the same agreement from registration until completion of the programme. This is to say, employees who have registered multiple agreements must keep to the same respective agreements and cannot replace one with another.

- The completion allowance is granted once-off in addition to the annual allowance and is deductible in the year of assessment in which the employee successfully completes the learnership, provided that sufficient proof of completion is supplied to SARS.

Allowance Amounts – Annual Allowance

Note: Disabled – ‘Confirmation of Diagnosis of Disability’ form available on SARS website.

When will tax rebates not be allowed?

-

- The employer is changed during the program. None of the companies may claim the tax rebate on completion of the program.

- A learnership is substituted with another learnership for the same employee.

- The same program is registered with the same employee more than once.

- The employee was unable to complete any other learnership the employer has entered with the employee.

- Another learnership contains the same training component as a newly registered learnership.

Calculating your Rebate

When the learnership lasts 12 months, you may claim the full rebate allowance. Anything less than 12 months will be apportioned by the relevant period as illustrated in this example.

[ydcoza_note]A learner with an NQF 3 is part of a learnership for a 3 month period out of one year.

3 months, divided by 12 months, multiplied by the applicable rebate.

3/12 x R40 000 = R10 000[/ydcoza_note]

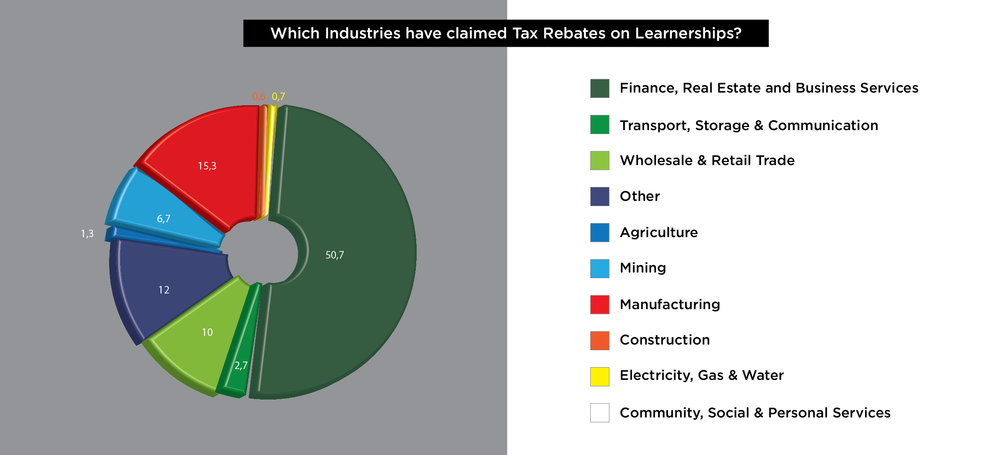

Which Industries have claimed their Learnership Tax Rebates?

[ydcoza_tip]Learnership tax incentive survey

About the survey: In May 2016, the National Treasury conducted an online survey on the Employment Tax Incentive (ETI) and Learnership Tax Incentive. The aim was to gather information from businesses on whether they have used the incentives, their experiences if they have, and to gauge if the incentives are achieving their stated objectives.

The survey was sent to business organisations and professional umbrella organisations. A total of 1 018 responses were received, 720 of which were complete. The study provides useful information on respondents’ views of whether the incentives are working or not. It also provided an opportunity for respondents to comment on how the incentives and the administration thereof can be improved.

Summary of Feedback from the survey

The learnership tax incentive is intended to encourage vocational training through formal learnership contracts, to encourage accredited workplace training by employers.

Its objectives are to:

-

-

-

- Promote skills development

- Encourage human capacity development

- Encourage job creation by reducing the cost of hiring and training employees through formally recognised learnerships

-

-

Feedback from the survey suggests that the learnership tax incentive seems to deliver on its objectives in terms of:

-

-

-

- Training, skills development, and employment:

Respondents suggested that the incentive makes it more attractive to hire and train young (inexperienced) people – doing so is more cost effective due to the incentive.

It is viewed as an instrument that enables businesses to grow the talent pool and increase their labour force - However, there appears to be a disconnect between the skills developed and business needs.

- Importantly, survey respondents indicated that the take up of the incentive would be much higher if their engagement with SETAs was more efficient, and the administrative burden in accessing the incentive was reduced significantly.

- Greater awareness of the learnership tax incentive and its related requirements would ensure that more companies access the incentive.

- In some cases, learnership programmes would have continued even in the absence of the tax incentive. It is thus important to take into account additionality when evaluating tax incentives like the learnership tax incentive.

- Training, skills development, and employment:

-

-

In Summary

Learnerships are an integral part of the country’s overall objectives to reduce poverty, increase job skills and improve the economic growth. For this reason, a tax incentive for registered learnership agreements was introduced. The purpose of this tax incentive is to encourage job creation by reducing the cost of hiring and training employees through learnerships; promote skills development; and encourage human capacity development.

[ydcoza_note] There is a potential tension between spurring innovation and achieving inclusivity – i.e. ensuring that all citizens are suitably skilled to participate in the economy, and benefit from economic growth.[/ydcoza_note]Technological improvements can have consequences for the distribution of (i) income, and (ii) opportunities to participate in appropriate education/training programmes and the labour market.

With technological advances bringing about many changes in the workplace, there is much discussion globally on the issue of jobs being made redundant. Technological advances can lead to a shifting of income from workers to owners of capital or intellectual property but also have the potential to create a mismatch between the skills taught in higher education facilities and those needed for future jobs.

Martin Wolf wrote two relevant articles, where one subtitle is: “The prospect of far better lives depends on how the gains are produced and distributed”.

This does not mean there should be a global shut down in technological improvements – there is no question that we need to continue innovating. Innovation has changed lives on the African continent. People can now send money to each other using their cell phones, and advancements in solar power have enabled many households to switch on a light for the first time, rather than relying on candles/paraffin. Of crucial importance is how societies adapt to ensure that the benefits of innovation are inclusive.

This is likely to require policies that help people to adapt to the changing economy. Up-skilling people with required skills is likely to lead to complementarity in technological advances, growth and employment so that the benefits of growth are shared more evenly. Improving the prospects of employability requires strategic thinking about re-skilling people to ensure that they are employable and that their skills set matches requirements of emerging and future job opportunities.[/ydcoza-quote]

Source document

[1] http://www.sars.gov.zaWhich are the most popular Learnerships?

At Triple E Trading, our most popular learnerships are Business Practice Qualification, Manufacturing, Engineering and Related Activities Qualification & AET Practice Qualification.

[ydcoza_tip]What are the benefits of using Triple E Training to host learnerships in your organisation?

-

-

-

- Skilled, experienced workers who need less supervision.

- Improved productivity.

- Identify and solve short-comings in your business.

- Educate and empower employees; creating a happy workforce.

-

-

Contact Triple E Training today. Let us assist you with your Learnership Tax Rebate Calculations. One of our skilled consultants will show you the best way for your business to make the most of the reimbursements that are available to you.